The Corporate Sustainability Reporting Directive (CSRD) is a new EU regulation that requires companies to disclose detailed sustainability and ESG data. Replacing the Non-Financial Reporting Directive, CSRD aims to increase transparency, accountability, and sustainable business practices across Europe. Learn what it means for your organisation and how to comply.

The Corporate Sustainability Directive (CSRD) is an European Union directive designed to enhance the scope and quality of sustainability reporting by corporations operating within the EU. It mandates the detailed disclosure of a wide range of sustainability-related information. The CSRD replaces the Non-Financial Reporting Directive (NFRD) to meet growing demands for transparency.

| Extended Reporting Requirements | Standardisation | Third-Party Assurance | Digital Reporting |

| Includes more companies. | Ensures comparability of information. | Introduces mandatory assurance for credibility. | Uses digital formats for easier access and analysis. |

The CSRD is part of the broader EU Sustainable Finance Framework, and it works alongside the EU Taxonomy and the Sustainable Finance Disclosure Regulation (SFDR) to achieve EU Green Deal goals.

The key elements of CSRD reporting include mandatory disclosure of environmental, social, and governance (ESG) impacts, risks, and performance using standardised EU criteria. Companies must follow the European Sustainability Reporting Standards (ESRS), ensure third-party assurance, and provide digitally tagged, comparable data aligned with the EU Green Deal and sustainable finance goals.

Double materiality allows for a dual focus reporting on how company operations impact ESG factors, and how ESG factors affect business operations. Following the CSRD directive, companies must report on Impacts, Risks, and Opportunities (IROs) related to their operations and value chain.

The objectives of the CRSD are:

| Transparency and Consistency | Reliable and Comparable Information | Support EU Goals | Foster Sustainable Practices |

| Standardised reporting for easy access and understanding. | Integrates sustainability with financial reports for comprehensive stakeholder insight. | Aligns with the European Green Deal and aims for climate neutrality by 2050. | Encourages integration of sustainability risks and opportunities into business strategies. |

The scope of CRSD is:

| Entities | Geographical and Sectoral Reach | Sustainability Information |

| All large companies, listed SMEs, and non-EU companies with significant EU operations. | Global impact, affecting companies across all sectors with significant EU presence. | Reports on ESG issues, impacts, risks, and opportunities related to business strategies. |

The CSRD applies to all large companies and all companies listed on EU regulated markets, excluding micro-enterprises. The list is estimated to cover approximately 50,000 companies, a significant increase from the 11,000 under the NFRD.

Companies should prepare for full compliance, building robust systems for data collection and reporting.

NFRD Companies Listed SMEs

From January 1, 2024 From January 1, 2026

First report due in 2025 First report due in 2027

Optional two-year opt-out with an explanatory statement

Omission of anticipated financial effects from climate and other environmental impacts allowed.

Qualitative disclosures allowed if quantitative disclosures are impracticable.

May omit data on GHG emissions, biodiversity, resource use, and social disclosures in first two reporting years.

CSRD requires companies to disclose detailed, standardised information on how sustainability issues affect their business and how their operations impact people and the environment. Disclosures must cover key ESG areas—such as climate, biodiversity, social responsibility, and governance—using the European Sustainability Reporting Standards (ESRS), with mandatory third-party assurance.

The disclosures can fall under financial and non-financial categories.

| Example | Description |

|---|---|

| Revenue and Profit Margins | Income generated and profitability over a given period. |

| Capital Expenditures (CapEx) | Investments in physical assets, including sustainability-related upgrades. |

| Carbon Pricing Liabilities | Costs or provisions related to carbon taxes or emissions trading schemes. |

| ESG-Linked Financial Instruments | Bonds or loans tied to sustainability performance targets. |

| Climate Risk Impact on Financials | Disclosure of how climate change affects assets, liabilities, and cash flow. |

| Example | Description |

|---|---|

| Greenhouse Gas (GHG) Emissions | Scope 1, 2, and potentially Scope 3 emissions across operations and supply chain. |

| Workforce Diversity and Inclusion | Gender, age, and ethnic diversity metrics; inclusion policies. |

| Human Rights Due Diligence | Measures to prevent and mitigate human rights violations in operations/supply chains. |

| Water and Waste Management | Data on consumption, recycling, and discharge practices. |

| Corporate Governance Structure | Board composition, ESG oversight responsibilities, and stakeholder engagement. |

| Governance | Structures Policies Practices related to sustainability |

| Strategy and Business Model | Sustainability strategy Objectives Alignment with overall business strategy |

| Impacts, Risks, and Opportunities (IROs) | Processes for identifying and assessing material impacts Sustainability risks and opportunities. |

| Metrics and Targets |

In conclusion, the Corporate Sustainability Reporting Directive (CSRD) marks a major shift in how companies across the EU—and beyond—report on their sustainability practices. By requiring transparent, standardised, and assured ESG disclosures, the CSRD aims to improve corporate accountability, empower stakeholders with better information, and drive the transition to a more sustainable, resilient economy.

The Corporate Sustainability Reporting Directive (CSRD) is an EU regulation requiring large companies and listed SMEs to disclose detailed, standardised information about their environmental, social, and governance (ESG) performance. It replaces the Non-Financial Reporting Directive (NFRD) and introduces mandatory third-party assurance, digital tagging, and reporting under the European Sustainability Reporting Standards (ESRS).

The CSRD applies to:

– All large EU companies (meeting 2 of the 3: €25M+ in assets, €50M+ turnover, 250+ employees)

– Listed SMEs (except micro-enterprises)

– Non-EU companies with €150M+ turnover in the EU and a significant operational presence (subsidiary or branch)

It is expected to affect over 50,000 companies, up from 11,000 under the NFRD.

Double materiality is a core concept of CSRD that requires companies to report:

– How sustainability issues impact the business (financial materiality)

– How the business impacts people and the environment (impact materiality)

This dual perspective ensures holistic ESG reporting aligned with stakeholder expectations and EU policy.

Under CSRD, companies must disclose both financial and non-financial sustainability information using the ESRS framework. Required disclosures include:

– GHG emissions (Scope 1, 2, and 3)

– Climate and biodiversity risks

– Workforce diversity and human rights

– Board governance and anti-corruption policies

– ESG-related CapEx and risk impacts on financials

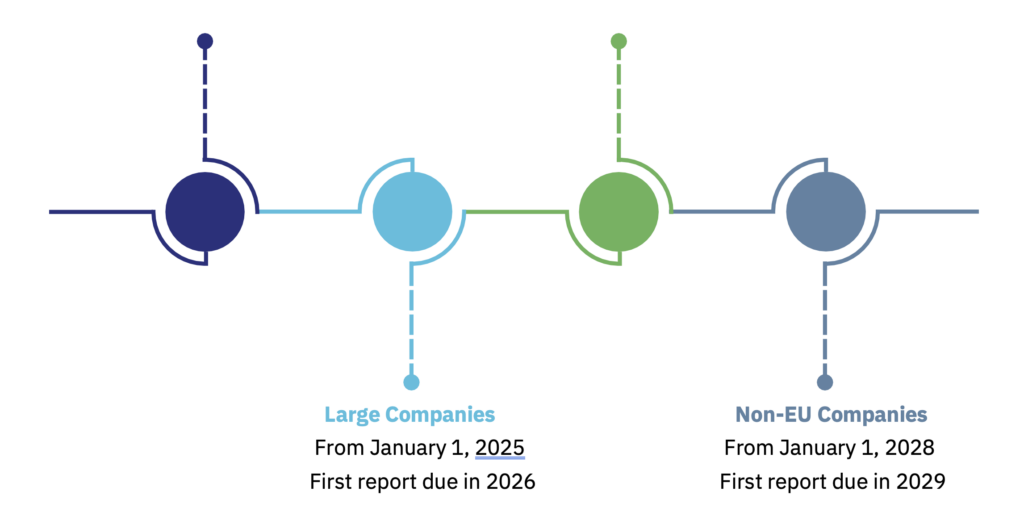

CSRD follows a phased implementation:

From Jan 1, 2024: Companies already under the NFRD

From Jan 1, 2026: Listed SMEs (with optional 2-year opt-out)

First reports are due in 2025 and 2027, respectively

Additional flexibilities apply in the first 1–3 years, including limited exemptions and qualitative disclosures.

Copyright © 2025. All Ireland Sustainability

Webdesign & Development Northern Ireland 2b:creative

Entries have now closed. We would love it if you could join us for our awards evening on the 24th of October at La Mon, Hotel, Belfast!